Faster underwriting. Smarter monitoring.

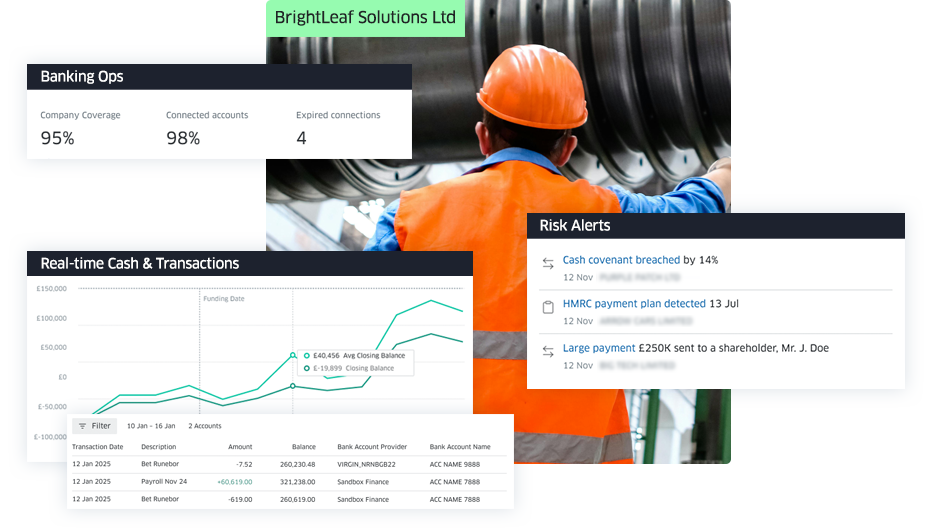

Navrisk consolidates SME bank data from any source, highlighting unseen signals that matter. Built by lenders to accelerate underwriting and enable real-time monitoring.

A partner in your process, not a replacement system.

Navrisk doesn’t replace your judgment, it sharpens it.

By ingesting PDF Statements and Open Banking feeds, consolidating cash across accounts and entities and standardising messy data, we eliminate blind spots and surface the signals that matter. Access a dedicated dashboard or integrate by API to fit your workflow.

Fast. Flexible. Built by lenders for lenders.

Complete Cash Visibility

Consolidate all accounts, entities, and bank sources into a single, reliable view.

Actionable Signals

Highlight trends and anomalies so teams can act with confidence.

Reduced Manual Work

Automate consolidation, categorisation, and anomaly detection across all data sources.

Flexible & Adaptable

Ingest PDF Statements and Open Banking feeds seamlessly into your workflow.

Make decisions with confidence.

Underwriters spend less time crunching numbers and more time assessing borrowers.

Risk Detection

Automatic flags for anomalies and hidden exposures.

Instant Metrics & Ratios

Borrower-level lending insights in seconds.

Flexible Workflows

Dashboards and views that adapt to your process.

Catch problems before they escalate.

Monitoring teams have real-time visibility surfacing signals without blind spots.

Real-Time Insights

Consolidated cash view across all accounts and entities, with automated categorisation of transactions, spend tracking, and liquidity analysis.

Early Warning Signals

Detect stress patterns like declining inflows, overdrafts, or unusual transfers before they hit reports.

Continuous Coverage

Always-on monitoring that ensures nothing slips through between reporting cycles.

We know SME lending — because we’ve done it.

Navrisk was created by SME lenders who faced messy bank data firsthand. We know the truth lies in the numbers, not reports or spreadsheets. By combining lending expertise with advanced data skills, we built a platform that delivers reliable insights, real-time alerts and robust automation to solve problems other tools can’t.

Messy bank data? We fix the foundation.

Navrisk ingests PDFs and Open Banking feeds, standardises all accounts and entities and creates a clean, reliable base for insights. With automated checks, anomaly detection and API-ready integration, your team sees the signals that matter. Fast, consistent and without blind spots.

Our advanced automations ensure uninterrupted access to bank transaction data with features including:

- connection tracking

- automated email workflows

- seamless consent renewals

These tools minimise data drop-offs, reduce manual effort and provide a frictionless experience for both lenders and their clients. Navrisk delivers reliable, real-time insights at scale.

Deep Categorisation

Turn raw bank transactions into insights, uncovering cash flow trends and patterns. Combining ML with LLMs to truly understand bank data.

Consolidated Views

Achieve a unified perspective with aggregated data across entities, accounts, and transactions.

Bank Connection Management

Streamline Open Banking integrations ensuring secure, uninterrupted access to financial data.

Managing borrower risk across the credit lifecycle

The Problem

Disjointed data and manual processes slow underwriting and obscure portfolio visibility.

Critical risk signals are missed due to outdated systems and delayed insights.

Reporting gaps hinder timely decisions and investor confidence.

Delivering benefit

"To-do lists keep halving and I'm alerted early, giving me more time to manage and support borrowers"

– Mike Millington, Portfolio Manager, SME Capital